Agili Financial Planning Analyst, Jennifer Pieson, FPQP™, developed our latest infographic to explain credit, credit scores, and credit cards to young adults. In the accompanying video, she adeptly describes the concepts in an easy-to-understand manner. A great resource to share with young people who want to build a strong credit history, this two-page infographic can be found here:

Check out our Credit Infographic!

A complete transcript of our latest video, “Credit, Credit Scores, and Credit Cards” is below in italics.

Video Transcript

Hi. I’m Jen Pieson from Agili, Your Personal CFO. I’m here today to talk about credit cards and credit scores. Sometimes thinking about credit makes people a little nervous. And credit cards can be tricky if you don’t understand the rules around how to use them.

I like to think about credit like a tool, like a knife in a kitchen. It can be dangerous if you don’t follow the rules, but it can be really helpful if you understand how it works and you use proper safety precautions to use that tool.

Debit Card vs. Credit Card

Debit cards and credit cards are different in one big way. Debit cards allow you to use the money that is already in your [bank] account and you’re not allowed to go over that balance. Credit cards allow you to use money up to your credit limit, which is often much more money than you would have in your bank account.

So, the number one rule with credit cards to avoid paying fees on interest, or any late fees, is to pay off that balance every month. In an emergency, there might be an instance where you would need to borrow more than you’re able to pay off in a month. But, as a general rule, really try to pay that balance off every month.

Credit Score Factors

Credit Score Factors

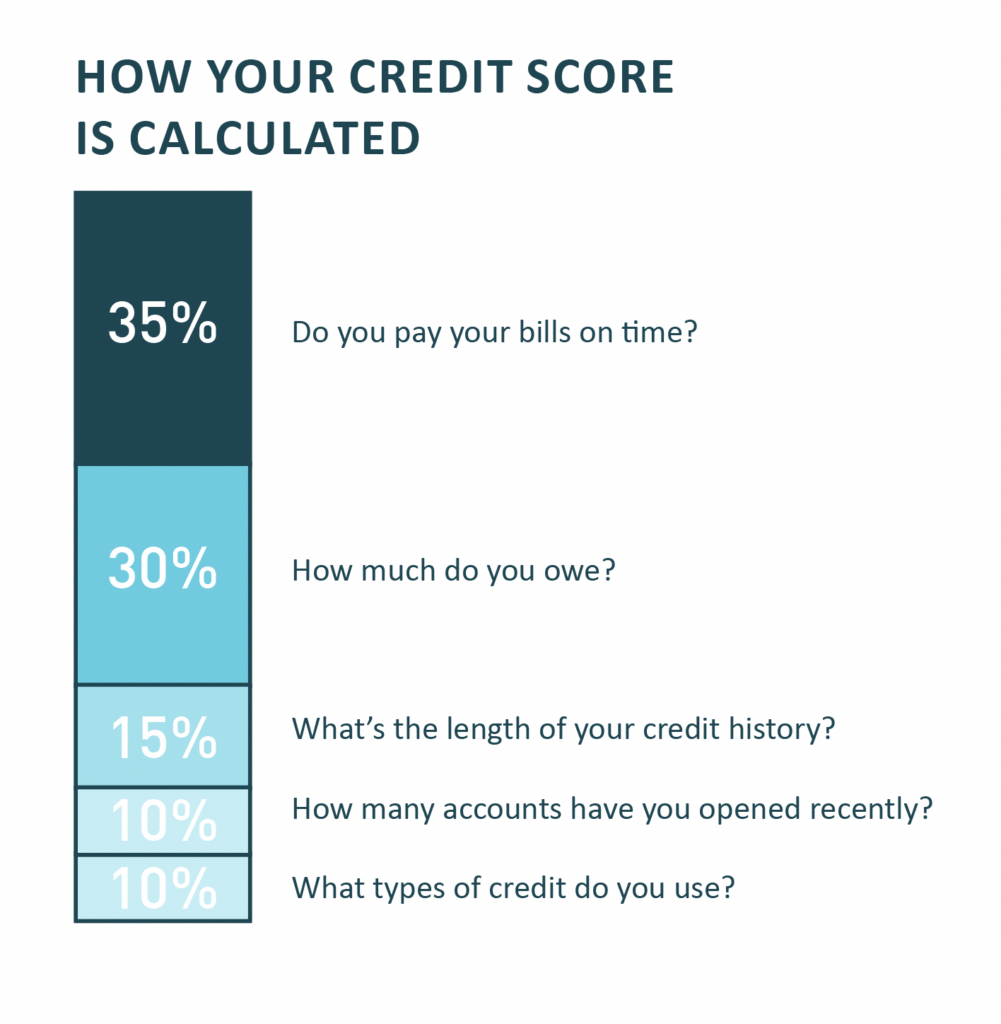

Your credit score is affected by five major things.

The first is paying your bills on time. Another element is, how much do you owe? What’s the length of your credit history? How many accounts have you opened recently? And what types of credit do you use?

The most important of all of those is paying your bills on time. And out of those bills, the most important to pay on time are your credit card and your mortgage. Of course, you should try to pay all your bills on time, but things like utility bills are not as important to your credit rating as these major ones.

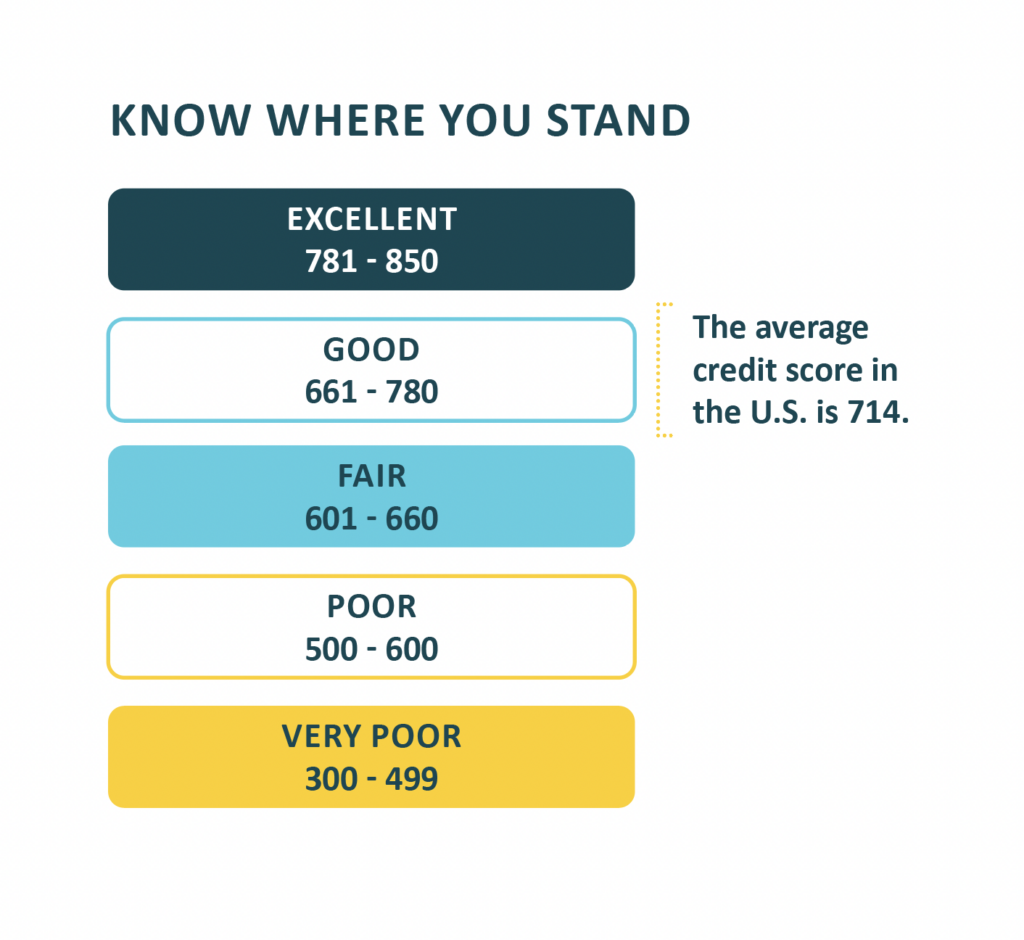

Credit Score Range

In the United States, our credit scores are anywhere between 300 points and 850 points. The average score in the United States is 714. Anything above about 660 is considered “very good” and anything above 780 is considered “excellent.”

Benefits of High Credit Scores

One of the main benefits of keeping your credit score high is that you’ll be eligible for reduced interest rates on loans, such as an auto loan or a mortgage. If you can get a loan for a lower interest rate, you can save thousands – or even tens of thousands — of dollars over the lifetime of that loan.

How to Build Your Credit

Now let’s talk about how to begin building your credit. You have to be 18 years old to be eligible to apply for a credit card. At that time, you can get either a student or a beginner credit card. As we said earlier, it’s very important to make your payments on time. You should at least pay the monthly minimum but try to pay that whole balance in full.

Now let’s talk about how to begin building your credit. You have to be 18 years old to be eligible to apply for a credit card. At that time, you can get either a student or a beginner credit card. As we said earlier, it’s very important to make your payments on time. You should at least pay the monthly minimum but try to pay that whole balance in full.

It’s best to keep your credit utilization under 30%. So that means, if you were approved for a $10,000 credit limit, try not to spend more than $3,000 on that card. Anything over that [percentage] will start to take your credit score down a little bit.

Don’t apply for multiple cards at one time. Try to spread those out and try not to have too many. And, keep your credit cards open. Part of your credit score depends on the length of your credit history. So if you can have a card open from the time that you’re 18, that will really give you a boost in that area.

Paying Your Credit Card Bill

When you apply for a credit card, you sign a contract with the bank that holds that credit card and you’re promising that you will pay that amount that you borrow back in full. You don’t need to pay that amount back every month – the credit card company will allow you to roll your balance from one month to the next. But when that happens, you will be paying interest on the amount that you’re rolling over to the next month. Interest rates on credit cards tend to be pretty high – often in the 20% area.

You do have a grace period between when you use your credit card and when you have to pay that balance back. Unlike a debit card which takes the money out of your account right away, a credit card, you might not have to pay that amount back for four to six weeks. But when it comes time to pay it back, the credit card company will tell you what your “minimum payment” is – which is just a small percentage of your overall balance. So, it’s important to pay that minimum balance but also try to pay that full balance whenever you can.

Please let us here at Agili know if you have any questions. We’re happy to help you. Reach out to your financial strategist or to any of us here at Agili and we’ll be happy to help you with any questions you have related to credit cards. Thank you.

Check out our Credit Infographic!

We would love to start a conversation with you about how Agili can help you reach your financial goals and objectives.