Written By: Jen Pieson

We talk about beneficiary designations a lot, but that’s because it’s so important. Verifying your beneficiary designations takes only a few minutes, and can avoid real problems down the line.

What kinds of accounts have beneficiaries?

Life insurance policies and traditional retirement plans (401(k)s, 403(b)s, SEP, SIMPLE, Traditional, and Roth IRAs, etc.) usually have beneficiaries specified.

However, there are also ways to add beneficiaries to some forms of taxable (non-retirement) accounts. Bank accounts and Certificates of Deposit can be designated as “Payable on Death” (POD) and Investment Accounts can have the “Transfer on Death” (TOD) designation.

It is even possible to add beneficiaries to US Savings Bonds (see article here).

What happens if I don’t designate beneficiaries?

If you don’t have a beneficiary designated, the institution that holds the account will pass the account according to the institution’s own rules. The order would likely be: passed to a spouse, if one exists; if not, then passed to the deceased owner’s estate.

What’s the big deal if my account goes to my estate?

Short answer: tax consequences. An IRA that passes directly to an estate will trigger a potentially large tax bill and will prevent the ability to “stretch” an IRA over a period of many years.

Do I need to add Contingent Beneficiaries?

Probably. It’s possible for your primary beneficiary to die before you, or at the same time as you. If that happens, and there is no contingent on record, your account will probably pass to your estate.

What’s “Per Stirpes” and do I need it?

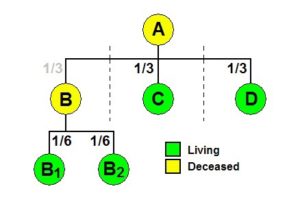

Per Stirpes, a Latin term meaning “by branch,” means that each branch of the family receives an equal share of the estate. Also known as “right of representation distribution,” per stirpes prevents excluding a deceased heir’s descendants. Below is a picture that shows per stirpes in action, assuming three generations: Person A has three children, one of whom has already passed away. Therefore, Child B’s share is passed to Child B’s children in equal shares.

Can I list my minor children as beneficiaries on my accounts?

Not if you can help it. For minor children, it’s better to leave assets in trust (with carefully chosen trustees). If you name children as beneficiaries, the court will likely appoint someone to oversee the funds, which can be expensive and difficult. Then, once the child in question turns 18 or 21, the money is theirs outright. A more carefully thought-out solution that we commonly see is a trust disbursing, for example, part of the principal to the child at age 25, then the remainder at age 30. In the meantime the trustee is able to withdraw from the trust as appropriate for the maintenance, education, health, and support of the child.

A note about Per Stirpes:

A married couple with minor children – who have had their wills written to create testamentary trusts as described above – has to be careful to name their beneficiaries appropriately. In this case, a husband will probably have his wife listed as primary beneficiary (100%), and the contingent beneficiary will be, for example, “The Smith Family Trust created in my last Will and Testament.” It is important NOT to choose “per stirpes” for this situation, because if you do, the children would get the funds outright anyway, since beneficiary designations supersede what you’ve written in your will. Choosing per stirpes in this situation would never allow the trust(s) to be opened.

What if I forget to update my beneficiary designations and keep them current?

Beneficiary designations take priority over what you have written in your will or trust. If the will says one thing (for example, names your current spouse), but the beneficiary designation remains as your former spouse, your former spouse will receive the account assets if you die first. This is why your team will review your beneficiary designations with you regularly.

Please let your financial strategist know if you have any questions about your beneficiary designations.