Written By: Dan Honsberger

I recently gave a presentation delineating the habits that need to be established so that more 401k contributors can become millionaires. Since I know that this information would be beneficial to many savers and investors, I want to share this information with Agili’s blog subscribers and beyond.

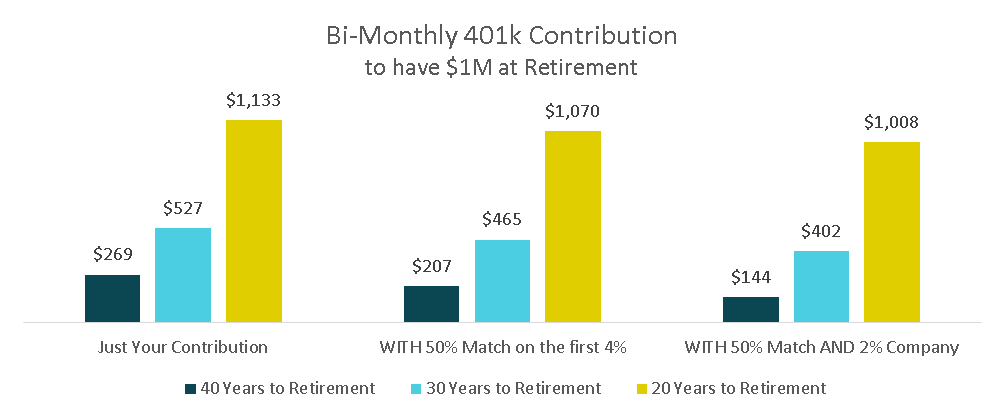

…You Start Saving Early and In an Automated Way

…You Take Advantage of the Employer Match

It’s free money and a great way to juice your savings.

…You Increase Contributions Along with Raises and Promotions

You can increase contributions without eating into take-home pay. If, for example, you get a 2% salary increase, you could increase your 401k contributions by 2% and still wind up with the same take-home pay.

…You Don’t Use the Account until Retirement

- Save for emergencies outside retirement accounts – 3 to 6 months’ worth of expenses is a good target.

- Prioritize saving for other goals alongside retirement – whether it’s a home purchase, a wedding, your kids’ education, or other items. Also remember that while you can take out a mortgage to buy a house, or a loan for college, you can’t take out a loan to pay for retirement.

…You Invest in Low-Cost Diversified Mutual Funds and ETFs

- If you are a set-and-forget investor, equities (US and international stocks) have the best long-term track record for rate of return.

- If large swings up and down in the market are hard to stomach, it’s a good idea to have a mix of equities and bonds which should have less volatile returns.

- Pay attention to minimizing the “expense ratio” of your investment funds – this can have a significant impact on long-term returns.

And… If You Can Save More, Do It!

A million dollars today isn’t worth the same as it was yesterday, and it won’t be worth as much tomorrow.

In fact, if inflation averages 2% over the next 40 years, a million dollars today will only buy ~$450,000 worth of goods at the end of that period.

To learn more about Agili and the services we offer, click here.